In the digital age, where data flows incessantly through interconnected networks, the integrity of personal information has become increasingly precarious. Nowhere is this more critical than in the realm of financial services, where the sanctity of sensitive data lies at the heart of trust between institutions and their customers. In this article, Aods.info delve into the multifaceted landscape of data privacy financial services, exploring its significance, challenges, and the imperative measures institutions must undertake to uphold it.

Contents

- 1 1. Regulatory Compliance and the Data Privacy Financial Services Mandate

- 2 2. The Principle of Data Minimization

- 3 3. Fortifying Security Measures

- 4 4. Customer Consent and Transparency

- 5 5. Anonymization and Pseudonymization

- 6 6. Implementing Data Access Controls

- 7 7. Developing a Data Breach Response Plan

- 8 8. Employee Training and Awareness

- 9 9. Managing Third-Party Risks

- 10 10. Continuous Monitoring and Compliance

- 11 Sum Up

1. Regulatory Compliance and the Data Privacy Financial Services Mandate

At the cornerstone of safeguarding data privacy financial services lie regulatory frameworks such as GDPR, CCPA, and various other regional laws. These regulations articulate the obligationfs of financial institutions concerning the collection, processing, storage, and sharing of personal data. Compliance with these mandates is not merely a legal obligation but a moral imperative to protect individuals’ rights to privacy and autonomy.

2. The Principle of Data Minimization

Financial institutions face the delicate balance of collecting sufficient data to fulfill their operational needs while respecting individuals’ privacy rights. The principle of data minimization underscores the importance of collecting only the necessary information, thereby reducing the risk exposure in case of breaches. By adopting a minimalist approach to data collection, institutions can mitigate potential vulnerabilities and enhance the security of sensitive financial information.

3. Fortifying Security Measures

The prevalence of cyber threats underscores the criticality of robust security measures in safeguarding data privacy financial services. Encryption, access controls, and regular security audits are indispensable tools in fortifying the digital perimeter against unauthorized access and cyberattacks. By implementing a multi-layered security framework, financial institutions can mitigate risks and instill confidence in customers regarding the safety of their data.

4. Customer Consent and Transparency

Transparency and consent form the bedrock of ethical data practices in financial services. Institutions must obtain explicit consent from customers before collecting, processing, or sharing their personal information. Moreover, they must provide clear and transparent information regarding how the data will be utilized, empowering individuals to make informed decisions about their privacy preferences. By fostering a culture of transparency and accountability, institutions can cultivate trust and strengthen their relationships with customers.

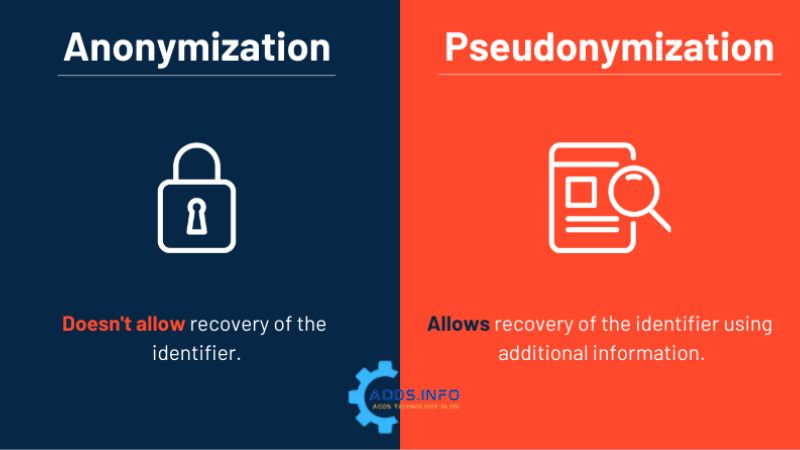

5. Anonymization and Pseudonymization

Anonymization and pseudonymization techniques offer additional layers of protection for sensitive financial data. By anonymizing or pseudonymizing data whenever feasible, institutions can mitigate the risk of identification in the event of a breach. These techniques enable institutions to leverage data for analytical insights and operational purposes while minimizing privacy risks and preserving individuals’ anonymity.

6. Implementing Data Access Controls

Effective data access controls are paramount in restricting access to sensitive financial information. Access should be granted on a need-to-know basis, with stringent authentication and authorization mechanisms in place to ensure that only authorized individuals can access the data. By enforcing granular access controls, institutions can mitigate the risk of unauthorized disclosures and maintain the confidentiality of customer data.

7. Developing a Data Breach Response Plan

Despite best efforts, data breaches can still occur, necessitating a swift and coordinated response. Financial institutions must develop comprehensive data breach response plans outlining the steps to be taken in the event of a security incident. This includes notifying affected individuals, regulatory authorities, and implementing measures to mitigate the impact of the breach. A well-defined response plan enables institutions to minimize reputational damage and uphold trust in the aftermath of a breach.

8. Employee Training and Awareness

Employees serve as the frontline defenders of data privacy financial services. Regular training and awareness programs are essential to educate employees about data privacy best practices and their roles in safeguarding customer information. By fostering a culture of vigilance and accountability, institutions can empower employees to recognize potential threats and adhere to data privacy protocols rigorously.

9. Managing Third-Party Risks

Financial institutions often rely on third-party vendors for various services, posing inherent risks to data privacy. It is imperative to assess the data privacy and security practices of these vendors to ensure they align with regulatory requirements and industry standards. By implementing robust vendor management protocols, institutions can mitigate third-party risks and safeguard the integrity of customer data.

10. Continuous Monitoring and Compliance

Data privacy financial services is not a one-time endeavor but a continuous commitment to vigilance and compliance. Regular monitoring and auditing of data privacy practices are essential to identify any potential vulnerabilities or gaps in security measures. By proactively addressing emerging threats and evolving regulatory requirements, institutions can uphold the highest standards of data privacy and maintain trust with customers.

Sum Up

In conclusion, data privacy financial services is a multifaceted imperative that demands unwavering commitment and vigilance from institutions. By adhering to regulatory mandates, adopting robust security measures, fostering transparency and consent, and prioritizing employee training, financial institutions can mitigate risks, uphold trust, and safeguard the integrity of sensitive financial data. In an era defined by digital interconnectedness, the protection of data privacy financial services is not merely a legal obligation but a fundamental ethical responsibility.